India’s Fintech Boom and Emerging Economy

Table of contents

- Have you ever dreamed of growing your career in the banking and fintech sector?

- Fintech in India: Fast-Growing Sector

- Fintech revolution in banking

- Fintech is one of India’s top upskilling choices

- Top Reasons to Choose Fintech as a Career.

- Why KGiSL Micro College?

Have You Ever Dreamed of Growing Your Career in the Banking and Fintech Sector?

Financial technology (FinTech) refers to websites, software, and digital platforms utility to manage financial activities. This includes transferring money, paying bills, applying for loans, purchasing insurance, and investing in stocks and mutual funds. Fintech is transforming the way we handle finances, making processes faster, easier, and more accessible.

Fintech in India: Fast-Growing Sector

With India being one of the fastest-growing countries in the banking and fintech sector, ranking third globally after the United States and China, the nation is home to over 7,000 fintech startups as of 2024. The industry is expected to reach a market size of $1.5 trillion by 2030, highlighting its immense potential and rapid growth.

Fintech Revolution in Banking

Fintech is an advanced version of traditional finance and represents one of the most significant transformations in the banking sector. It is cost-efficient, fast, convenient, and innovative, with a wide reach achieved in a short period.

The shift from traditional banking to fintech has led to the creation of mobile banking apps, partnerships with fintech startups, the use of AI to detect fraud, the introduction of robo-advisory services, and the digitization of customer onboarding processes.

Fintech has also faced several challenges, including system upgrades, cybersecurity issues, changes in government regulations, and the adoption of new tools and technologies. Initially, many people struggled to adapt to these services, but over time, they began to understand and appreciate the many benefits fintech has to offer.

Fintech is One of India’s Top Upskilling Choices.

A large number of students and professionals are looking to enter the fintech sector because of economic and technological growth.

Career Opportunities in Fintech :

- Fintech Marketing Specialist

- Financial Advisor (Tech-based)

- Fintech Compliance Consultant

- Fintech Analyst

- Digital Transformation Consultant

- Product Manager

- Risk and Compliance Officer

- Digital Transformation Consultant

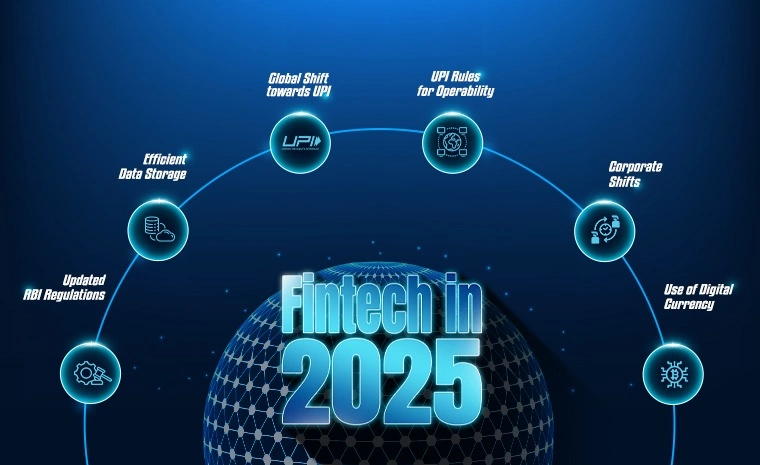

Recent Updates in Fintech:

1. Updated RBI Regulations

The Reserve Bank of India (RBI) is updating rules to make digital banking safer and better.

2. Effecient Data Storage

A cloud storage system will soon be deployed by the RBI to securely store financial data within India.

3. Global Shift Towards UPI

India’s popular payment system, UPI, is now accepted in several countries like Singapore, the UAE, and France. This helps people send money easily across borders.

4. UPI Rules for Operability

The group that manages UPI (NPCI) made new rules to prevent system overloads so payments can happen faster and without errors.

5. Corporate Shifts

- Razorpay, a big fintech company, moved its main office back to India from the US to focus more on Indian customers.

- PayPal got approval from the RBI to help Indian exporters get paid more easily from other countries.

6. Use of Digital Currency

More people are using the e-rupee, and the RBI plans to test it for international payments.

Top Reasons to Choose Fintech as a Career

A career in banking and finance is one of the best choices today, especially as India’s economy is growing rapidly. The fintech industry has emerged as one of the most widely used technologies, playing key roles in digital payments, online banking, insurTech, lending platforms, and much more.

If you are looking to build a long-term career and upskill your knowledge, consider enrolling in a banking course.

If you are considering a career in banking and fintech, join KGiSL MicroCollege, where you will gain a complete understanding of fintech in India and the banking sector.

Why KGiSL MicroCollege?

KGiSL MicroCollege offers industry-relevant courses in digital marketing, data science & analytics, full-stack development, DevOps, cybersecurity, SAP, and banking across Coimbatore and Kerala.

The institution supports flexible learning through both online and offline modes. Learning platforms like LMS and Coursera are also provided to students to enhance their learning experience.

Get in touch with industry experts at KGiSL MicroCollege today and take the first step toward a successful career in banking and fintech.